The game of soccer changes. Every year, another innovation in tactics swings the proverbial center of power to another city, another coach, and another team.

Tax laws change too. Every year there are new rulings, new language, and new ways to plan.

In fact, if you weren’t paying attention, a major overhaul of the American tax system just happened that has wide-ranging ripple effects, including some that have a significant impact on Philadelphia Union and Bethlehem Steel.

This is not an article about taxes per se, but rather one about a specific ripple for the Philadelphia area’s local soccer clubs.

A (wildly oversimplified) tax primer

This section is not tax or financial advice.

When a person owns an asset and sells it, often times that person pays taxes because of that sale.

You own a house that’s worth more now than when you bought it? You might owe taxes on your gain (the amount above what you paid for the house). You bought stock in a company that grew and you captured some profits? You might owe taxes on that profit too.

There have always been ways to soften the blow of those taxable gains. The recent tax law has created an opportunity to soften them even more.

The Tax Cuts and Jobs Act of 2017 created areas of the country called Qualified Opportunity Zones (QOZ). These tracts of land, existing in all fifty states, are defined as “economically distressed communit[es] where new investments, under certain conditions, may be eligible for preferential tax treatment.”

Intrigued?

Here’s a wild oversimplification of what this means:

- A person (or most types of businesses) sells an asset for a gain.

- That person then takes those gains and moves them into an investment in a QOZ (like a piece of real estate), or a fund that invests in QOZs.

In making this investment in “economically distressed communities,” the new tax law affords that person three perks:

- A deferral of the initial taxes owed for up to 10 years;

- Up to a 15% discount on said taxes when they are finally due;

- The ability to earn an unlimited amount of future growth in that QOZ investment without having to pay federal taxes.

Again, wildly oversimplified and not at all meant as guidance, but substantial nonetheless.

“Maps, they don’t love you like I love you”

The Chester waterfront and former Bethlehem Steel plant sit directly in these sorts of zones.

This is a map of the Chester Waterfront, with I-95 in the top left corner and the Commodore Barry Bridge running diagonal across the middle. Union fans will recognize this parcel of land.

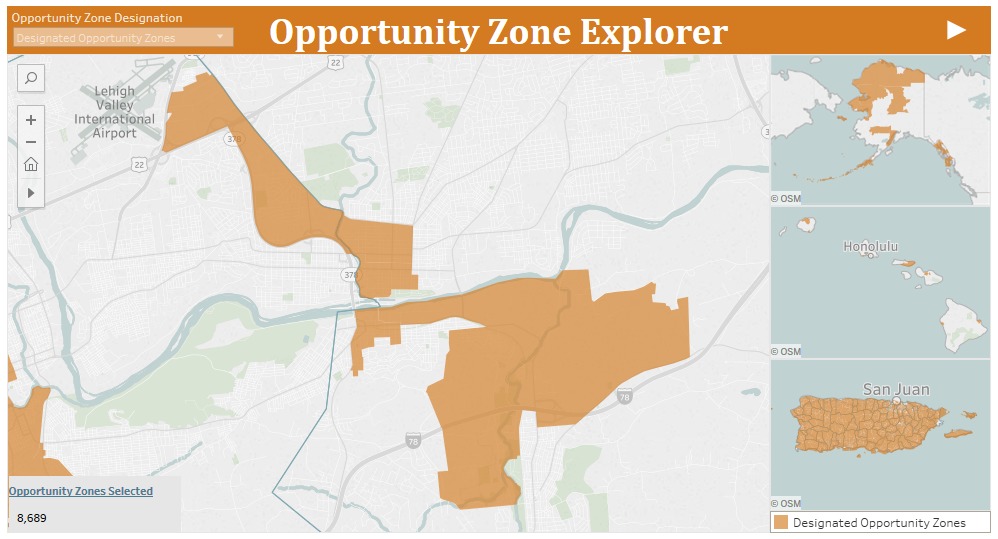

This is a map of the Lehigh Valley waterfront, centered on Bethlehem, with the Lehigh River running across. Steel FC fans will recognize this map.

Long-time Union fans will remember that part of the plan for the Union and for Chester has always been an expansive waterfront development project. When the team were awarded their franchise in 2008, Major League Soccer’s then-website published this:

“The stadium will serve as the hub of a $500 million waterfront development project that will also feature townhomes, apartments, office space, a convention and exposition center, retail space, new streets, greenways and a riverside promenade that will include boat slips.”

The Great Recession and a change in local political leadership put the brakes on that (and for the authoritative work on this topic, read Matt DeGeorge’s two-part opus. In the case that recession troubles be labeled an excuse and not a reality, consider that iStar, Union owner Jay Sugarman’s real estate investment company, lost approximately 98% of its value during this time period with him as the likely majority shareholder).

This new tax change could rev the engine once more.

Putting two and two together

The Camden Waterfront is a QOZ, as are many parts of North Philadelphia. There is unquestionably economic opportunity in those places. Big swaths of Point Breeze are QOZs too, despite a decade of breakneck gentrification and ever-increasing home prices. In that same incredible vein, much of University City also finds itself as a QOZ.

All of these locations, and many of the urban QOZ plots, are places where new money is already changing the character of old neighborhoods. This happened without a broad tax incentives like the one here. Adding fuel to this fire might only increase the rate of change.

The fact that the two places where the Union play soccer and where Steel might play in the future are QOZs perhaps shouldn’t come as a surprise. Part of the incentive for bringing the team to Chester was inexpensive land and an opportunity for growth-oriented development. Part of what the the team are looking for in the Lehigh Valley could be characterized similarly. There has always been a plan for investment in these areas, just not matched with the right timing.

Soccer changes over the years, mostly for the better. Taxes change too, a meandering stream of good and bad.

Sometimes they intersect.

Nice piece, Chris.

applaud the YYYs reference [thumbs up emoji]

+1

Forever waiting for the boos-cruise soccer-ferry from Penns Landing.

edit:

It’s roughly 20 miles down river which is about a 1 hour ride by boat. A Spirit of Philadelphia size boat can hold 500 people. How much would you pay to take a ride to and from the game? $20? I’d probably pay 20 bucks.

Bristol has installed floating docks right by the King George restaurant that would work for people who might have boats. It’s quite a sight to see as I was eating dinner how many people docked their boat and came into the restaurant. Sadly I agree that the development around the stadium is the biggest disappointment so far. The problem with Chester is that most fans are in an out on game day and the idea of building a business around 17-30 something events that might take place at the stadium is just not economically feasible. Opening up the waterfront would be a way to appeal to a different crowd though but you still need an attraction other than the stadium events.

honestly, this would be my dream commute to a match in Chester. if you gave me $20 with a bar on the boat, i’m there. if you do all-inclusive, both ways, light fare, $40. better than tailgating in gravel and on an under-developed waterfront.

–

the fanbase isn’t there for more than a one-off but, damn, i’ve been dreaming of this since 2012.

“There has always been a plan for investment in these areas, just not matched with the right timing.”

.

Perfectly describes this ownership’s product on the field and lack of real estate development.

.

I understand ownership purchased some of the surrounding properties – in hopes of consolidating the area. My gut tells me it isn’t for this ownership to develop… rather to appeal to a future ownership group.

“My gut tells me it isn’t for this ownership to develop… rather to appeal to a future ownership group.”

.

When the owner owns and runs a real estate development company, that would be really sad if true.

It took them several years to “develop” a grass field in an empty parking lot. These jokers don’t have the cash or ability to build anything.

.

Also, I really love the idea that Jay Sugarman was a victim of the recession…

I don’t think the word “victim” is the right one, but when a company loses 98% of its value over two years (and has only recovered to 20% of its pre-Recession value since), it probably reassesses investment plans and capital expenditures.

Right, but Sugarman didn’t sell the team for a reason. He knows its value increases regardless of his investment. The guy lucked out on buying a team before the cost/value went through the roof. If Sugarman can’t compete.. well after the recession… than maybe MLS HQ should politely encourage him to sell..

.

It’s frustrating the same man who got a stadium for nothing is also in a position to enjoy more tax benefits. Yeah iStar stock price is still in the shitter, but Jay didn’t suffer one bit from the recession.

Maybe MLS HQ should break his kneecaps and persuade him to sell, you mean.

Any development of the area would be good. I don’t know if it should start with housing then the retail end or both at the same time. Good read either way.

It requires nearly an hour to listen to the Q & A that was done live on Facebook with Ernst Tanner and Chris McDermott. I get that an hour is a long time well spent in the pursuits.

.

McDermott said that within the last year or 18 months the organization has bought the old Chester Power Station office building, and he said they have bought up the pieces of the campus that they previously did not own.

.

If they can populate the office building, that would generate revenue.

.

Something might begin to happen.

They’re eligible for this incentive even in the case that they already own the land/property if they invest at least as much as they paid to purchase the property in improvements (I believe). So, the land cost $1 million and they spend $1,000,001 to improve it using QOZ – qualifying dollars? It counts.