Below are the updated season forecasts using data from games through March 26, 2017.

Power Rankings

The “Power Rankings” we concoct are the “strength” of the team according to its competitive expectations. They are computed by forecasting the expected points (3 x win-probability + 1 x draw-probability) against every MLS team, both home and away, and taking the average per team.

SEBA has the Union remain in 19th. A win on the road against D.C. would do wonders for the model’s expectations of the Union. Following that up with a home win against a seemingly strong Portland team would also make a big difference.

The following shows the evolution of SEBA’s power rankings for the MLS East over time.

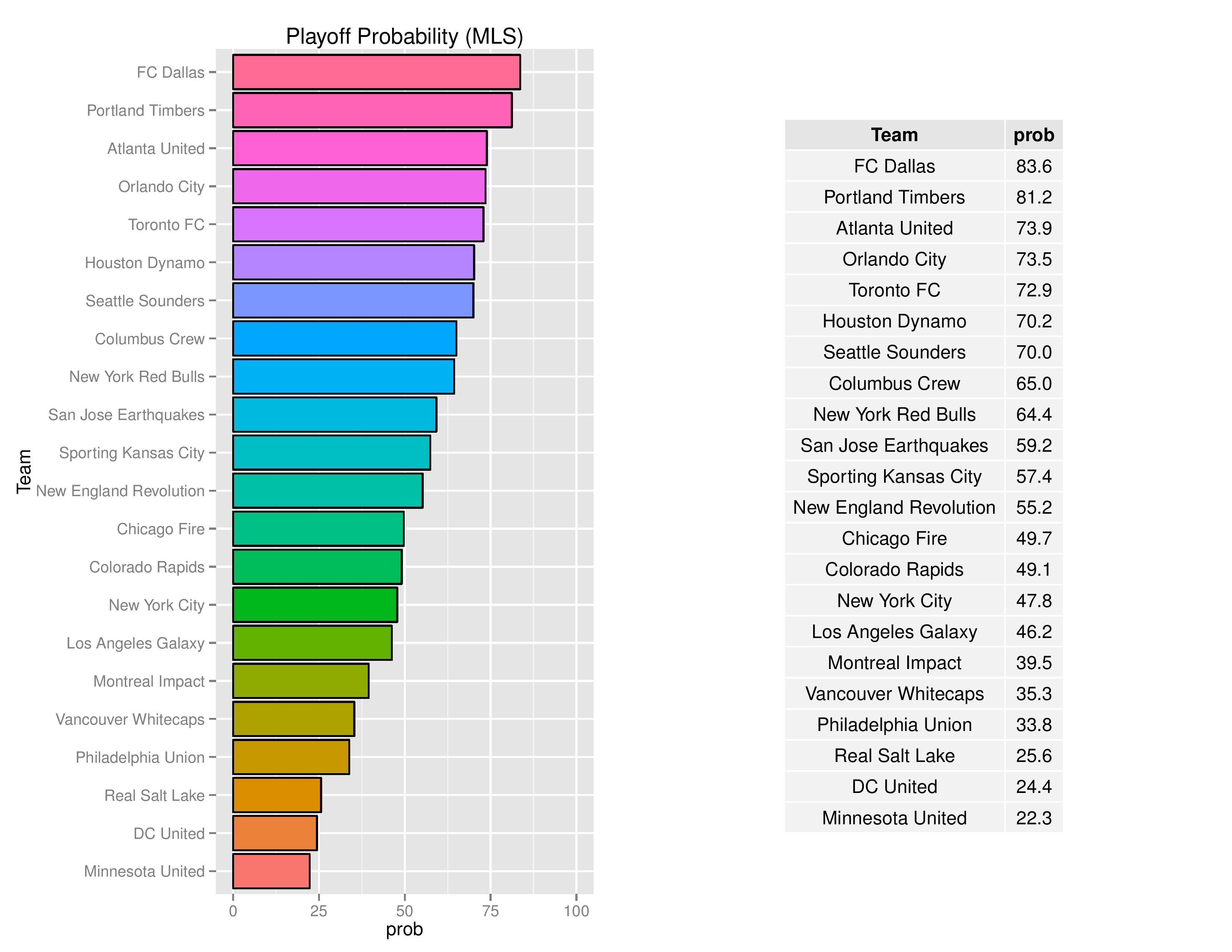

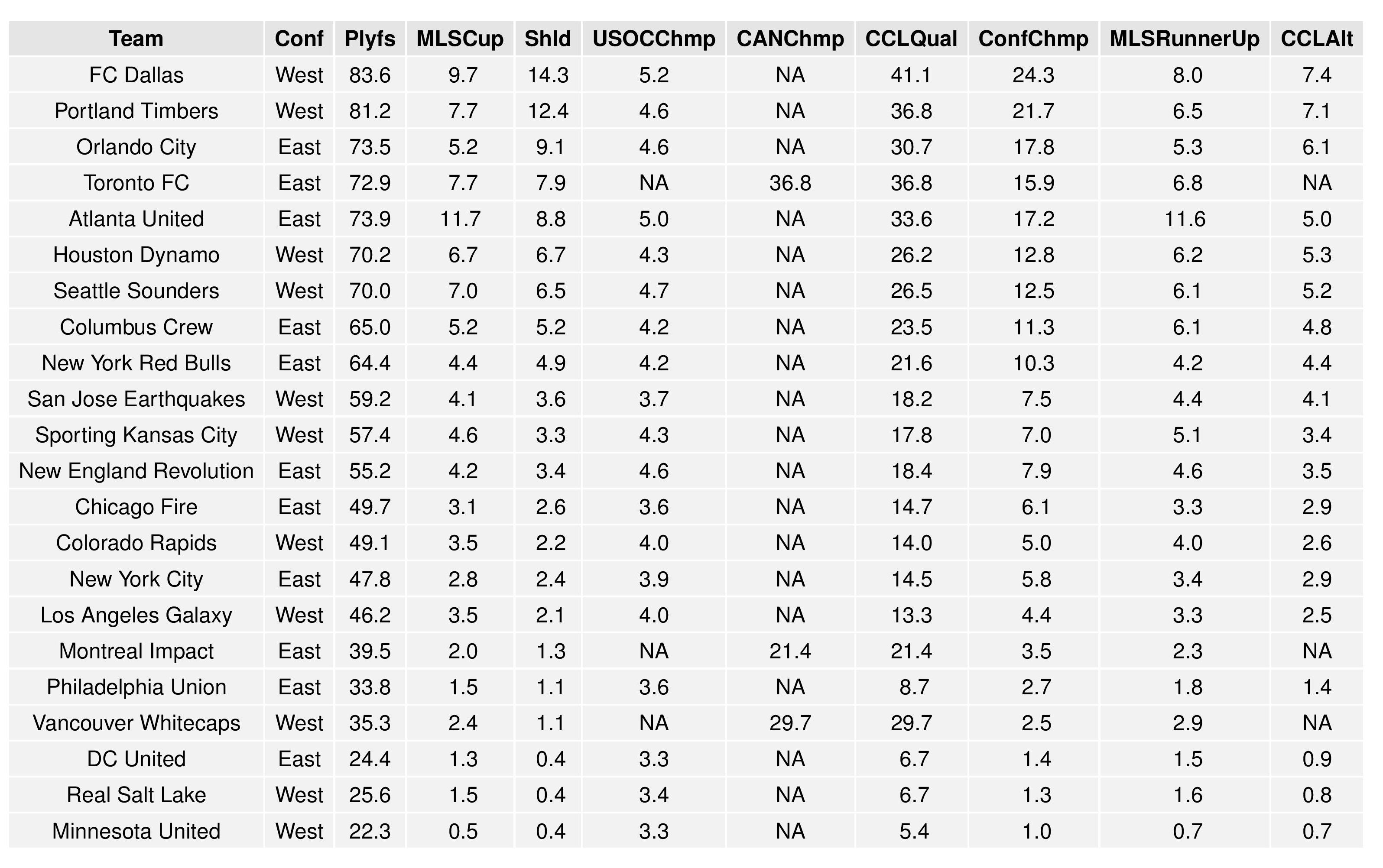

Playoffs probability and more

Philadelphia’s playoffs odds declined from 42.9% to 33.8% from the last published forecast.

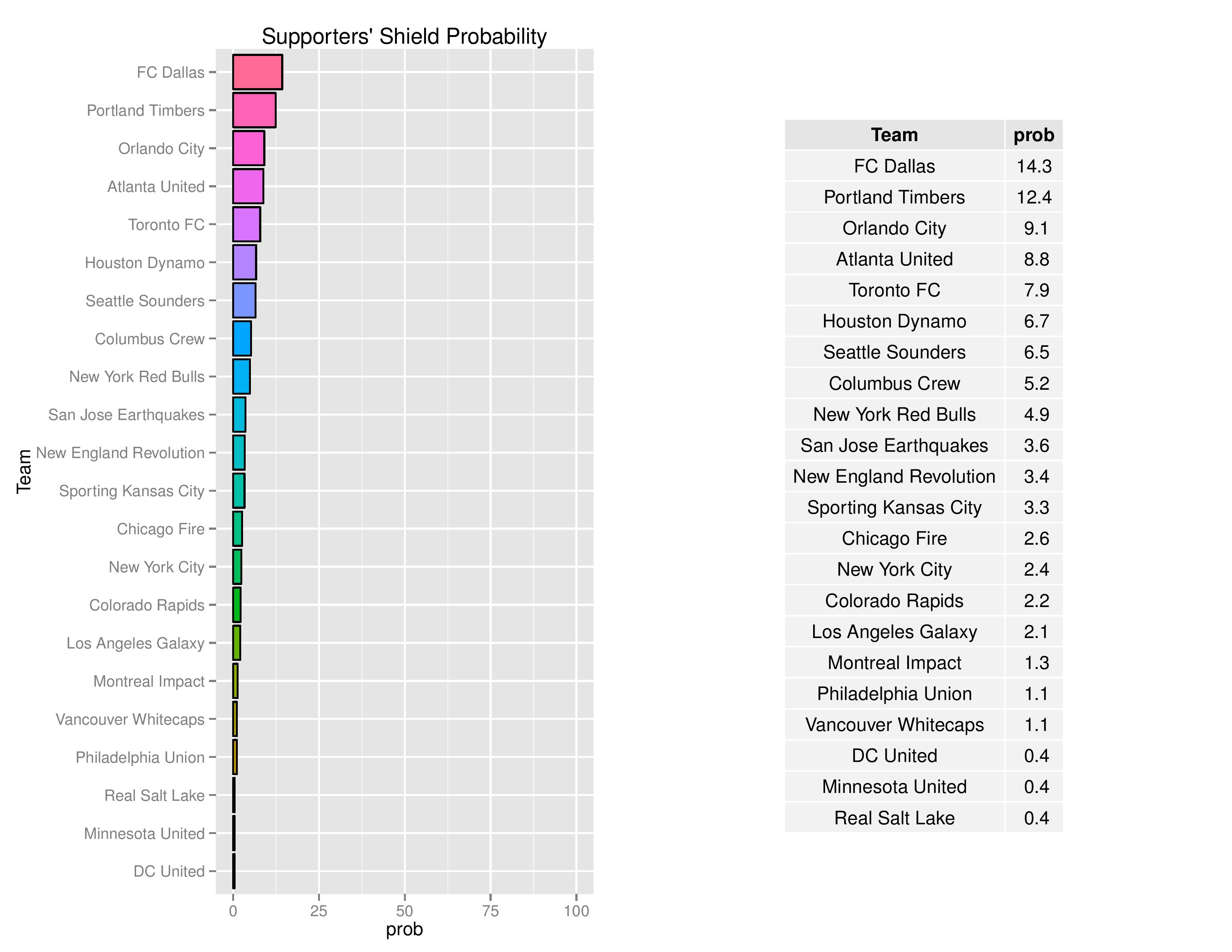

Philadelphia’s odds to win the Supporters’ Shield have declined from 1.6% to 1.1% from the last published forecast.

The Union’s chances of winning the MLS Cup have decreased from 2.5% to 1.5% from the last published forecast.

In part, clubs which have been obtaining large values for Goal Differential thus far are given an advantage in MLS Cup due to the 2-leg aggregate goal format of the conference semi-finals and conference finals. Atlanta is probably not likely to sustain as high a pattern of goal-scoring as they have been, and therefore their odds should decrease even if their power ranking remains the same.

Philadelphia’s odds of winning the U.S. Open Cup remain at 3.6%.

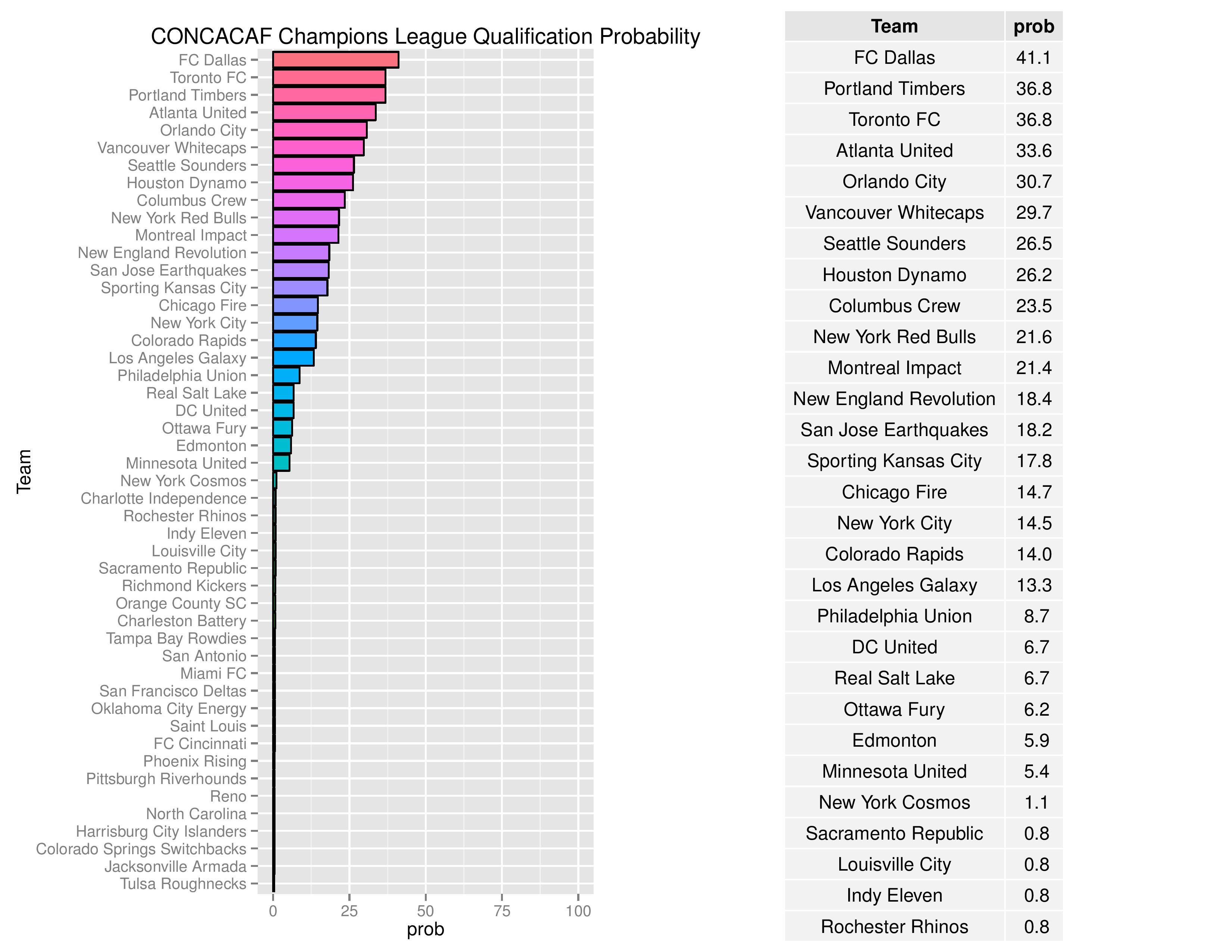

Philadelphia’s chances for qualifying for the 2018-2019 edition of the CONCACAF Champions League have dropped from 12.3% to 8.7% from the last published forecast.

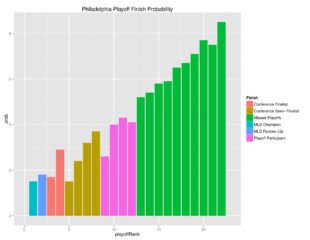

Over time, we can see how Philadelphia’s odds for different prizes change.

The gradual decrease isn’t solely due to MLS results, but also due to allowing the model to make bolder predictions upon the data at hand.

The following are probabilities for each category of outcomes for Philadelphia.

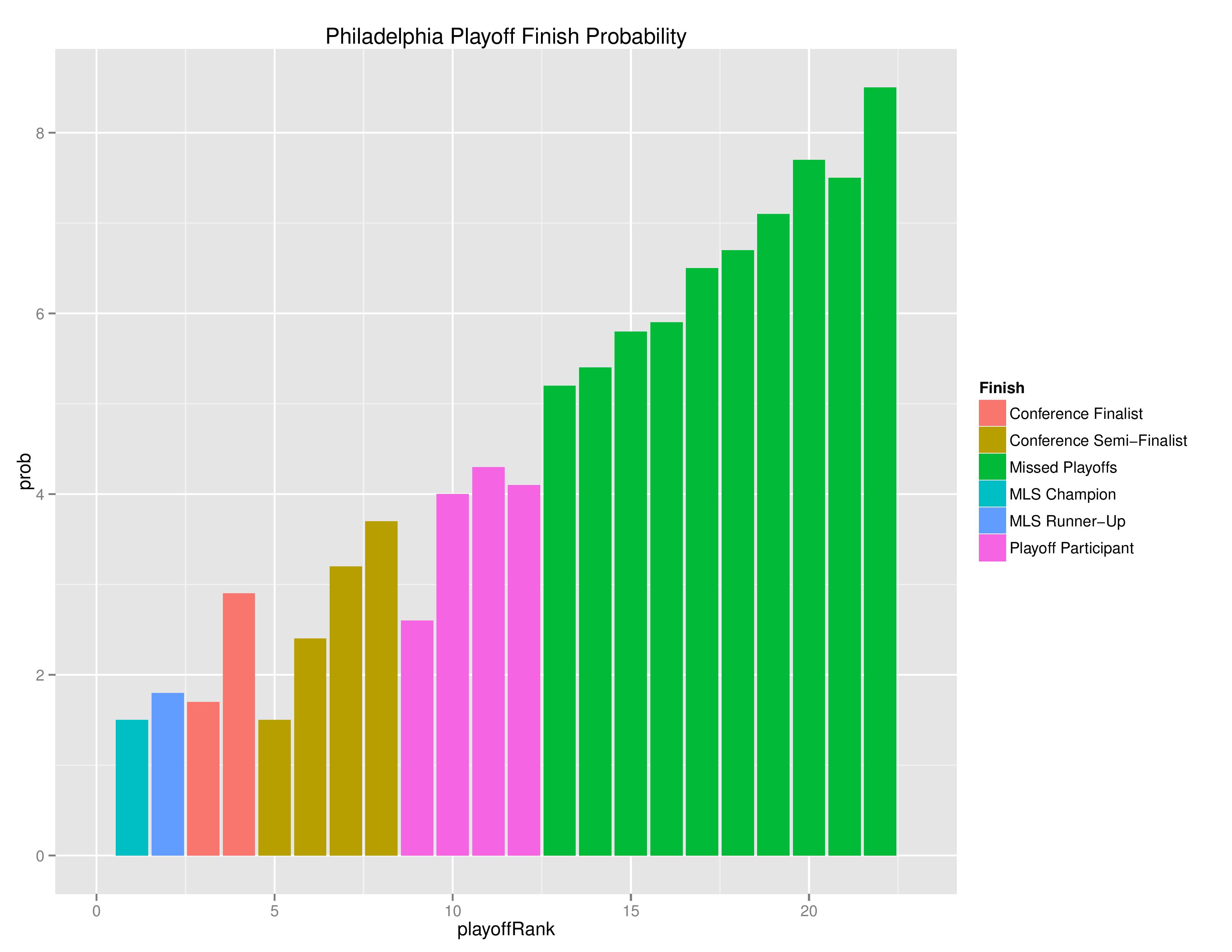

The following shows the relative probability of the prior categories. If the projection system were entirely random, these bars would be even, despite that “Missed Playoffs” is inherently 10 times more likely than “MLS Cup Champion.” The chart outlines where the club is headed.

The following shows the probability of each post-playoff ranking finish.

The following shows the summary of the simulations in an easy table format.

(Being expansion clubs, Minnesota’s and Atlanta’s goal data offer an extraordinarily small sample size and are therefore rather crazy at the moment. That will change soon…. we think with Minnesota?).

Additionally, you may be wondering why power rankings don’t necessarily correspond with projected finish. While some of it is due to strength-of-schedule, there is likely another explanation making a larger contribution. As you can see from the power rankings chart earlier in the article, the model does not currently have enough evidence to judge the skill of teams as significantly different from one another (and doesn’t often see as large an impact even with a larger data set). Therefore, projecting the outcome of the season is fairly reliant upon points-in-hand and home field advantage. While individual simulations can vary significantly from points-in-hand, when all simulations are averaged as below, they are more likely to swing based upon the points-in-hand. At the moment, some clubs who are deemed worse have obtained points-in-hand, particularly in comparison to their home-field-advantage-expectations.

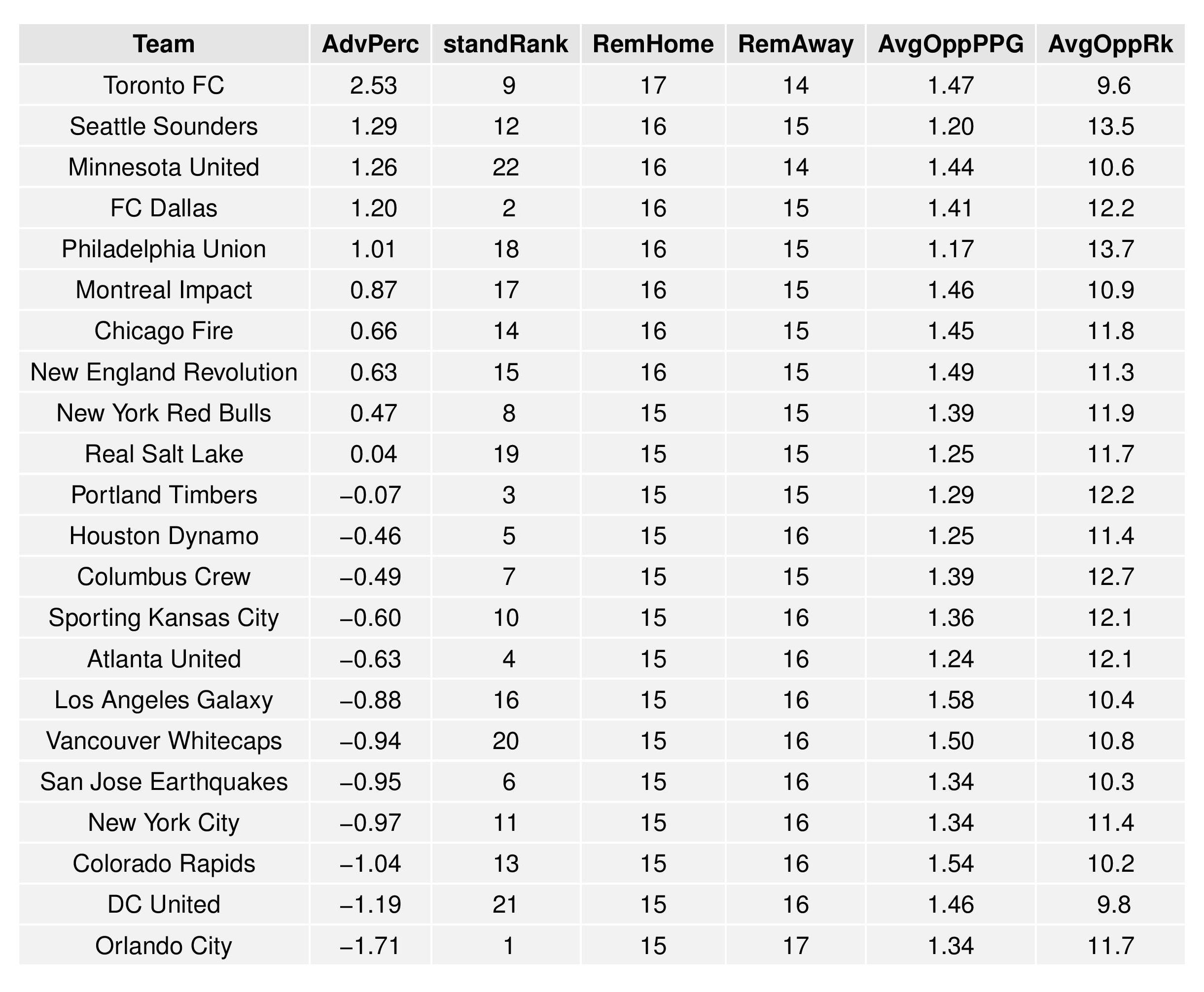

As a new feature, we can also show how the Remaining Strength of Schedule affects each team.

The “Points Percentage Advantage” shown on the X-axis represents the percentage of points expected over the league average schedule. This “points expected” value is generated by simulating how all teams would perform with all remaining schedules (and therefore judges a schedule based upon how all teams would perform in that scenario).

In short, the higher the value, the easier the remaining schedule.

Remaining home field advantage will make a large contribution here. It can also be true that a better team has an ‘easier’ schedule simply because they do not have to play themselves, which would be the case of Toronto. Likewise, a bad team like Minnesota may have a ‘harder’ schedule because they also do not play themselves.

The table following the chart also shares helpful context with these percentages.

Accompanying the advantage percentage in the following table is their current standings rank (right now ties are not properly calculated beyond pts/gd/gf; I may fix that, but maybe not for a while), the remaining home matches, the remaining away matches, the current average points-per-game of future opponents (results-based, not model-based), and the average power ranking of future opponents according to SEBA.

In the future, I may try to do an ‘Overall’ (past and future) strength of schedule, however, given that our model now discounts matches held earlier in the season as well as those with a roster that differs from the current one being employed, this may not be straightforward.

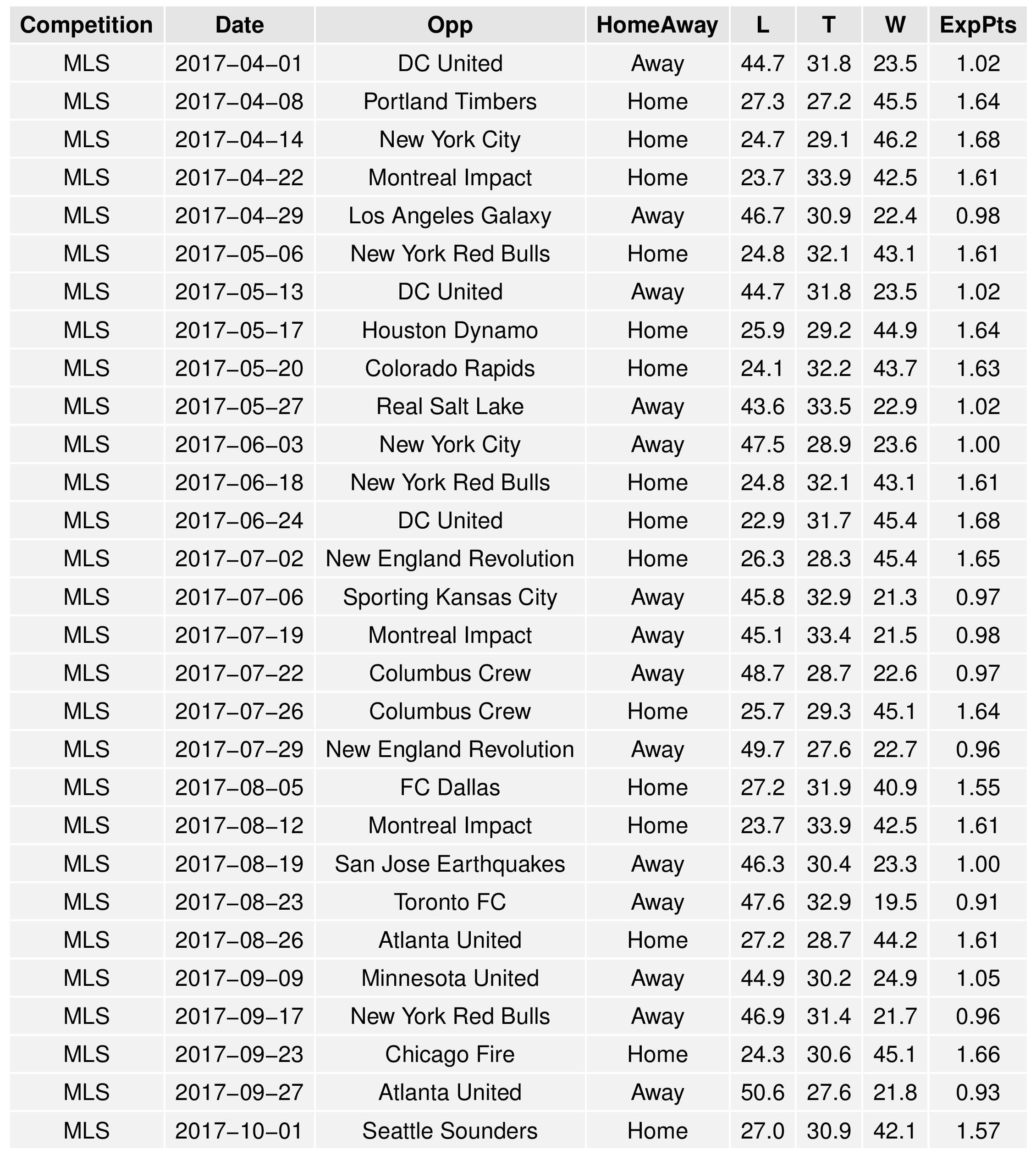

The following shows the expectations for upcoming Philadelphia matches:

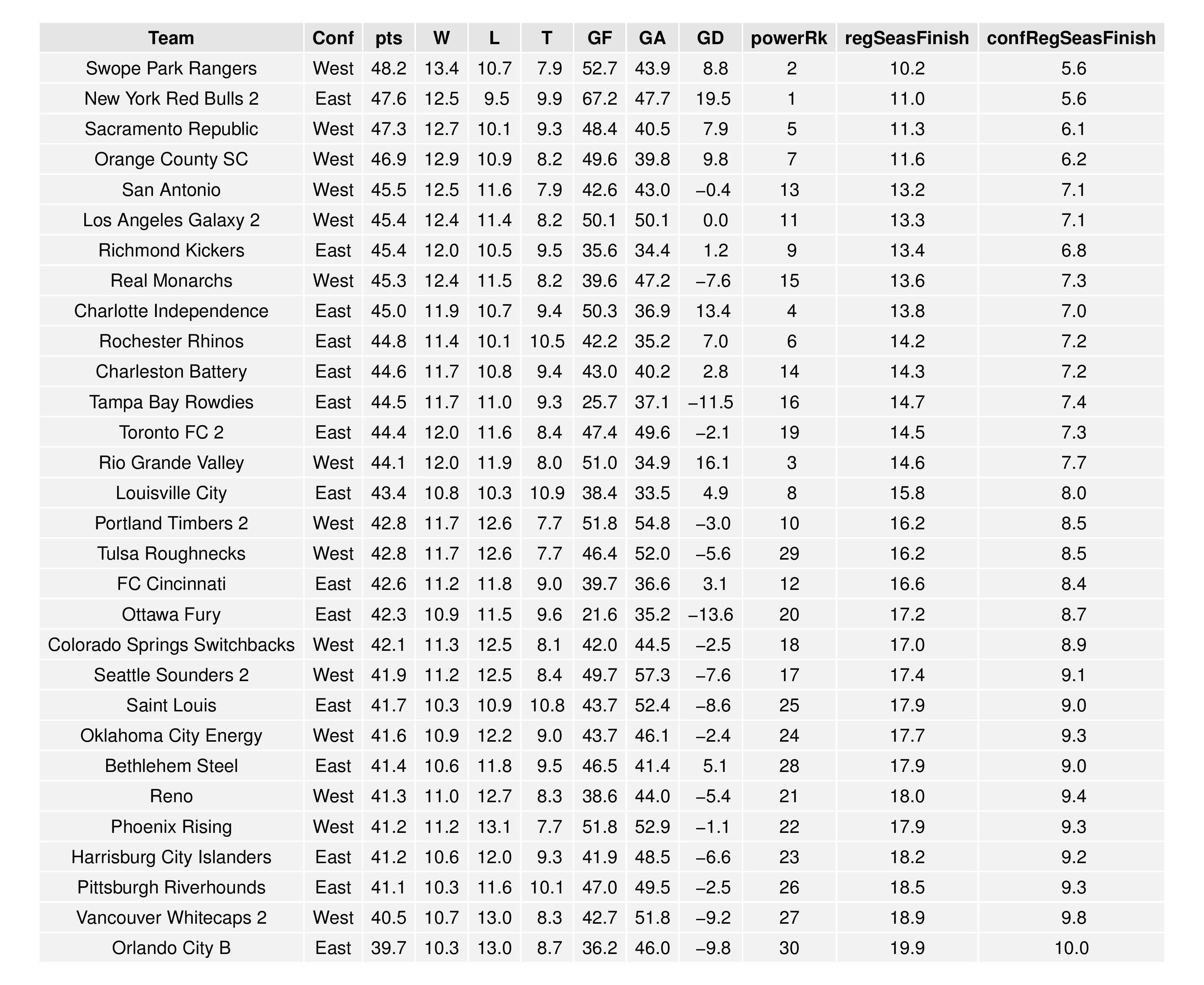

USL

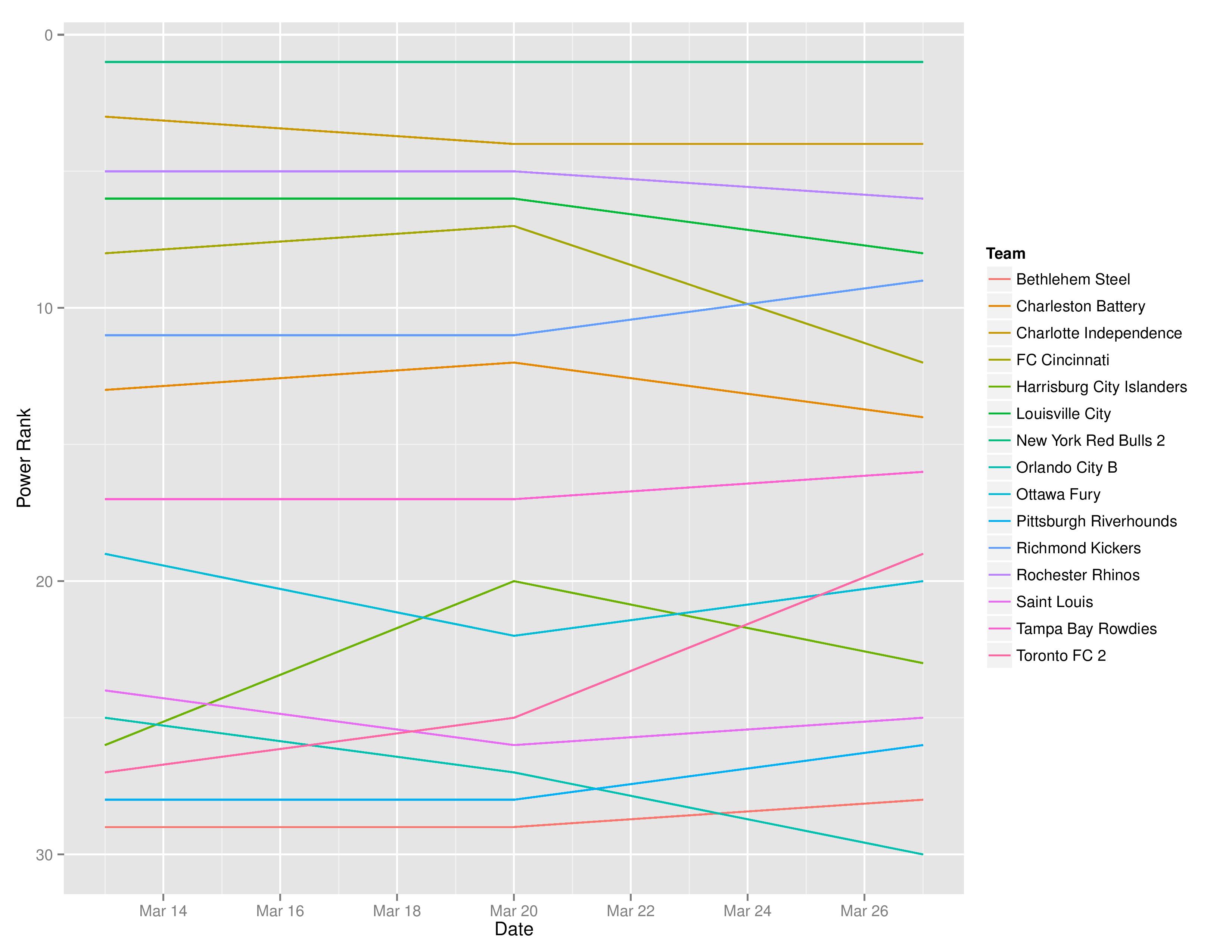

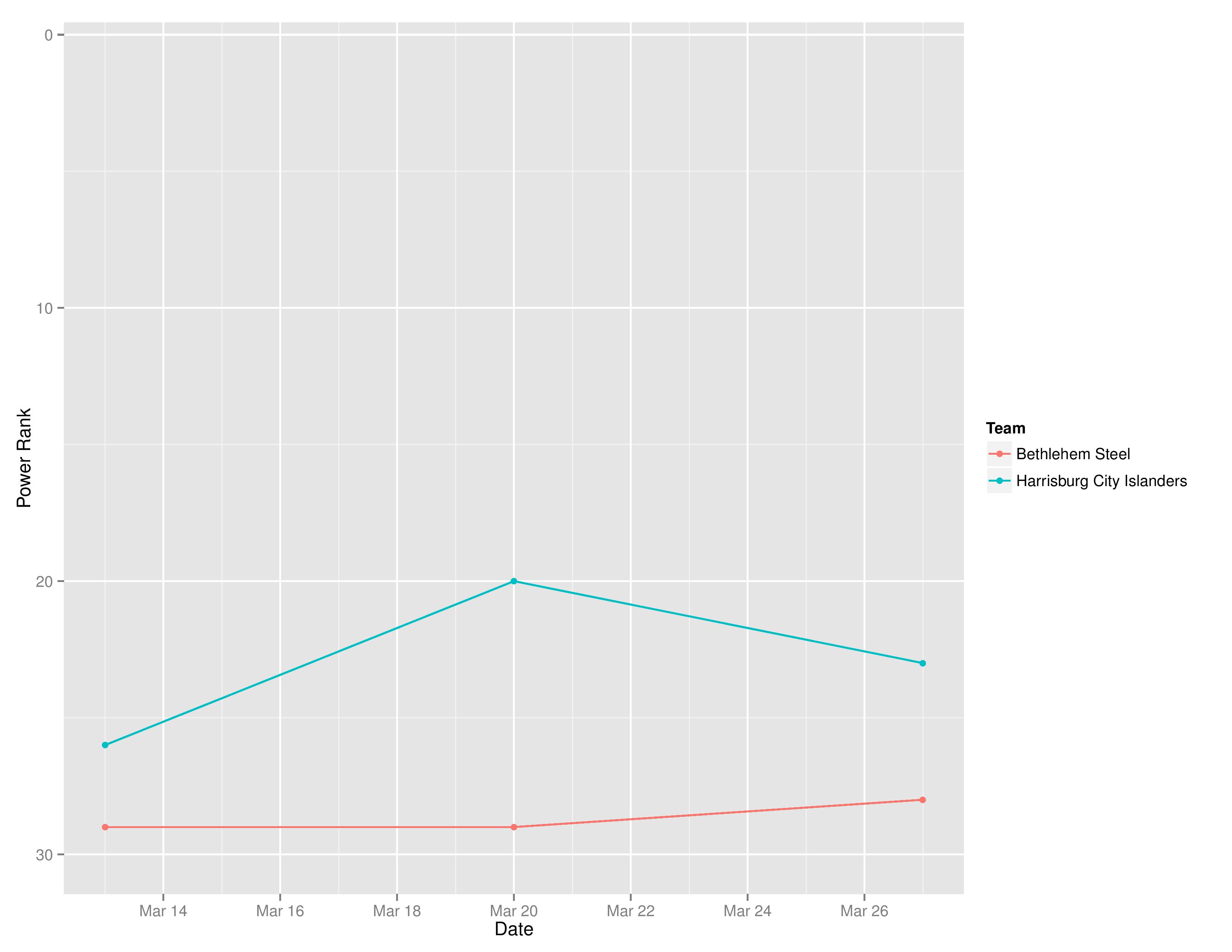

Power Rankings

SEBA has Bethlehem Steel increase to 28th from 29th. It has Harrisburg City move up to 23rd from 26th since the last published forecast (they actually decreased upon their loss, but a retroactive run for last week initially gave Harrisburg a bump. I can explain why if you want in the comments).

The following shows the evolution of SEBA’s power rankings for the USL East over time.

Playoffs probability and more

It should be noted with all of the USL forecast, that the model is the same as the MLS model (as teams from different leagues do compete against one another). Therefore, unlike with the preseason MLS forecast, I am not able to manually constrain the model’s parameters to avoid drawing bolder conclusions upon existing (2016) data in a different way than MLS clubs (which now have 2017 data to draw upon). As a result, some of these projections will be a bit bolder than we can reasonably expect given the data at hand. This will correct itself as we get more USL data, but it is worth calling out.

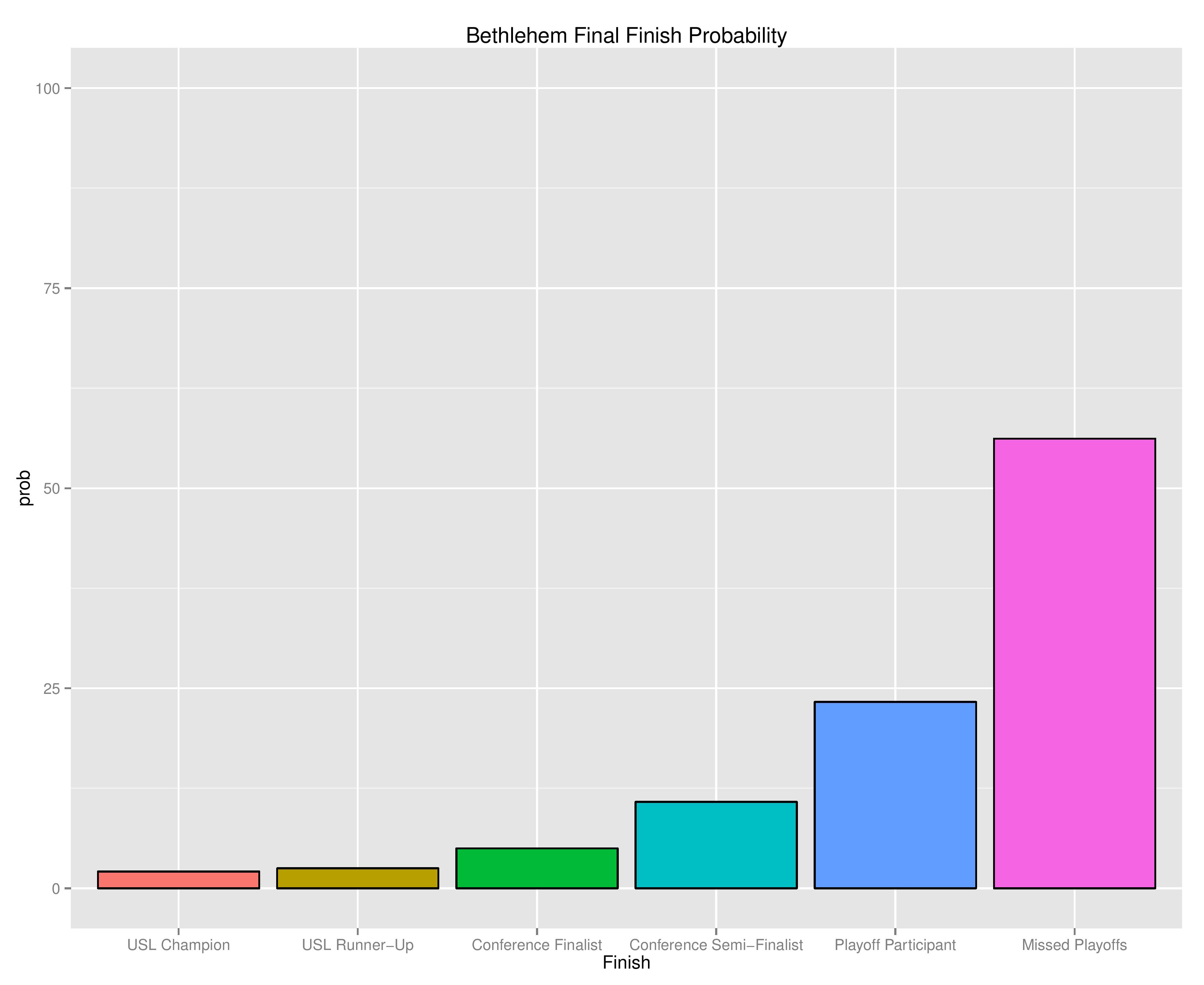

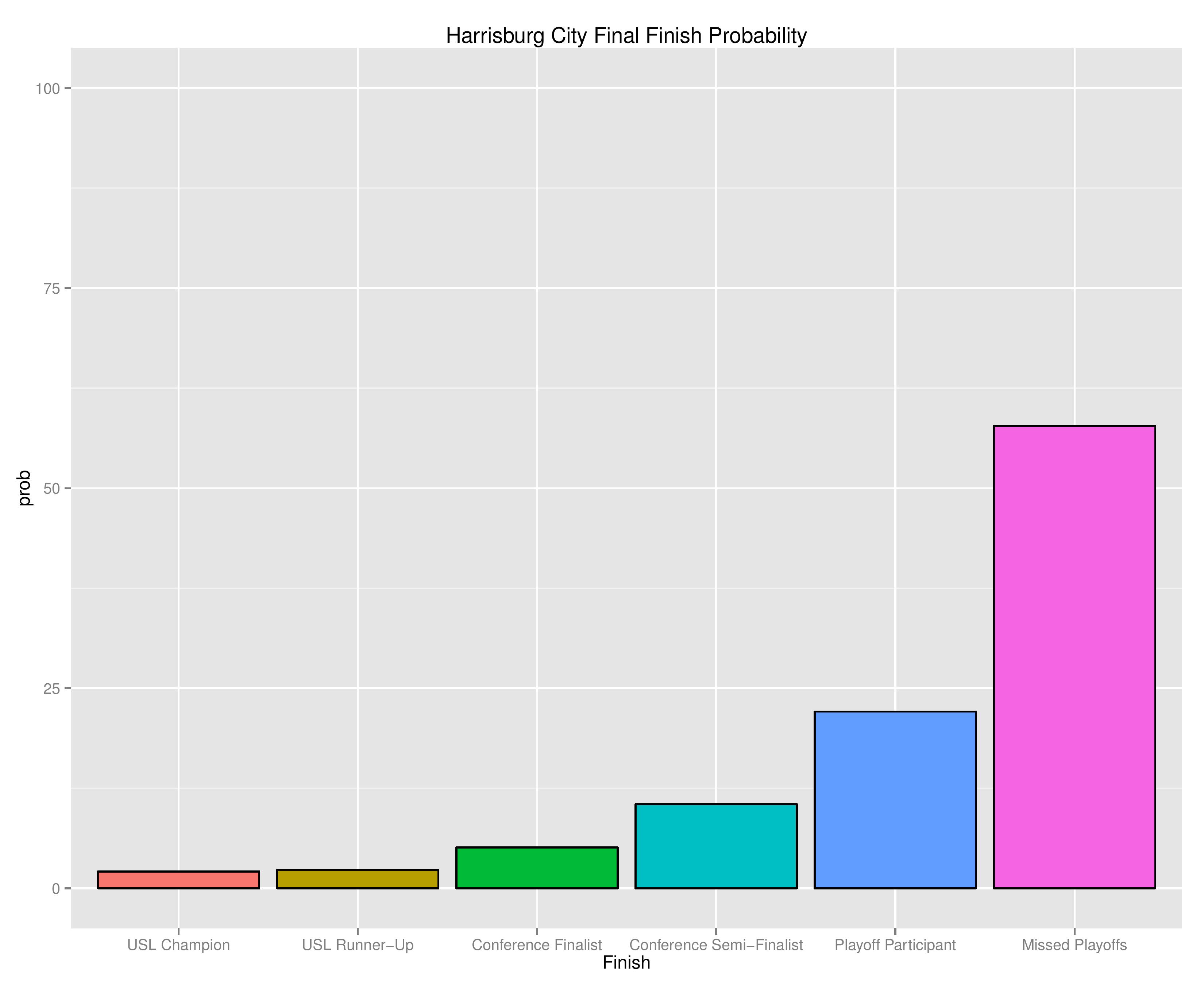

Bethlehem’s playoff odds increased to 43.8% from 41.4% and Harrisburg City’s odds declined from 42.4% to 42.2% in making the playoffs.

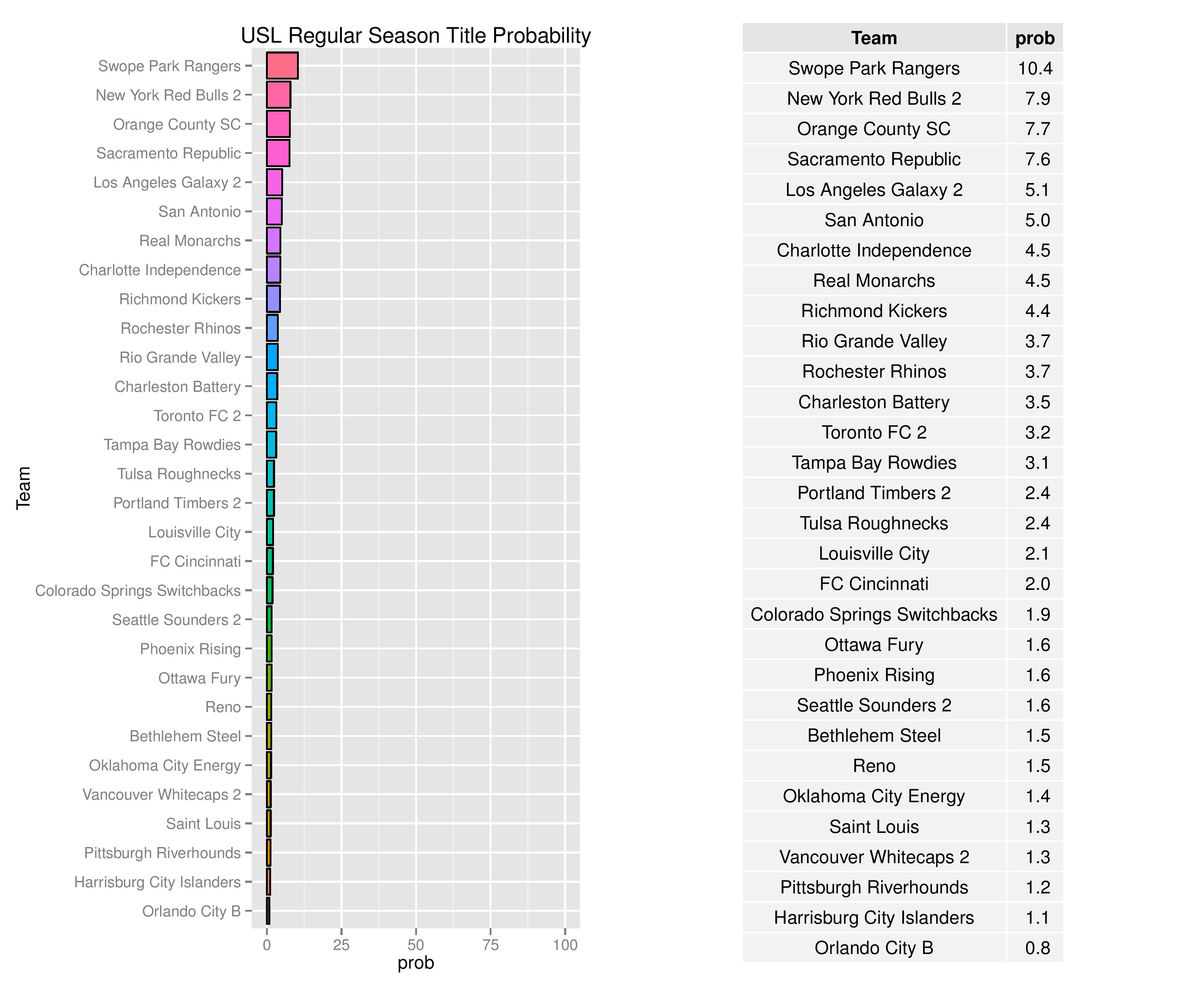

Bethlehem’s chances at winning the Regular Season Title increased to 1.5% from 1.3% while Harrisburg City declined to 1.1% from 1.3%.

Bethlehem’s odds at becoming the USL Champion have increased to 2.1% from 1.6% while Harrisburg City’s decreased to 2.1% from 2.2%.

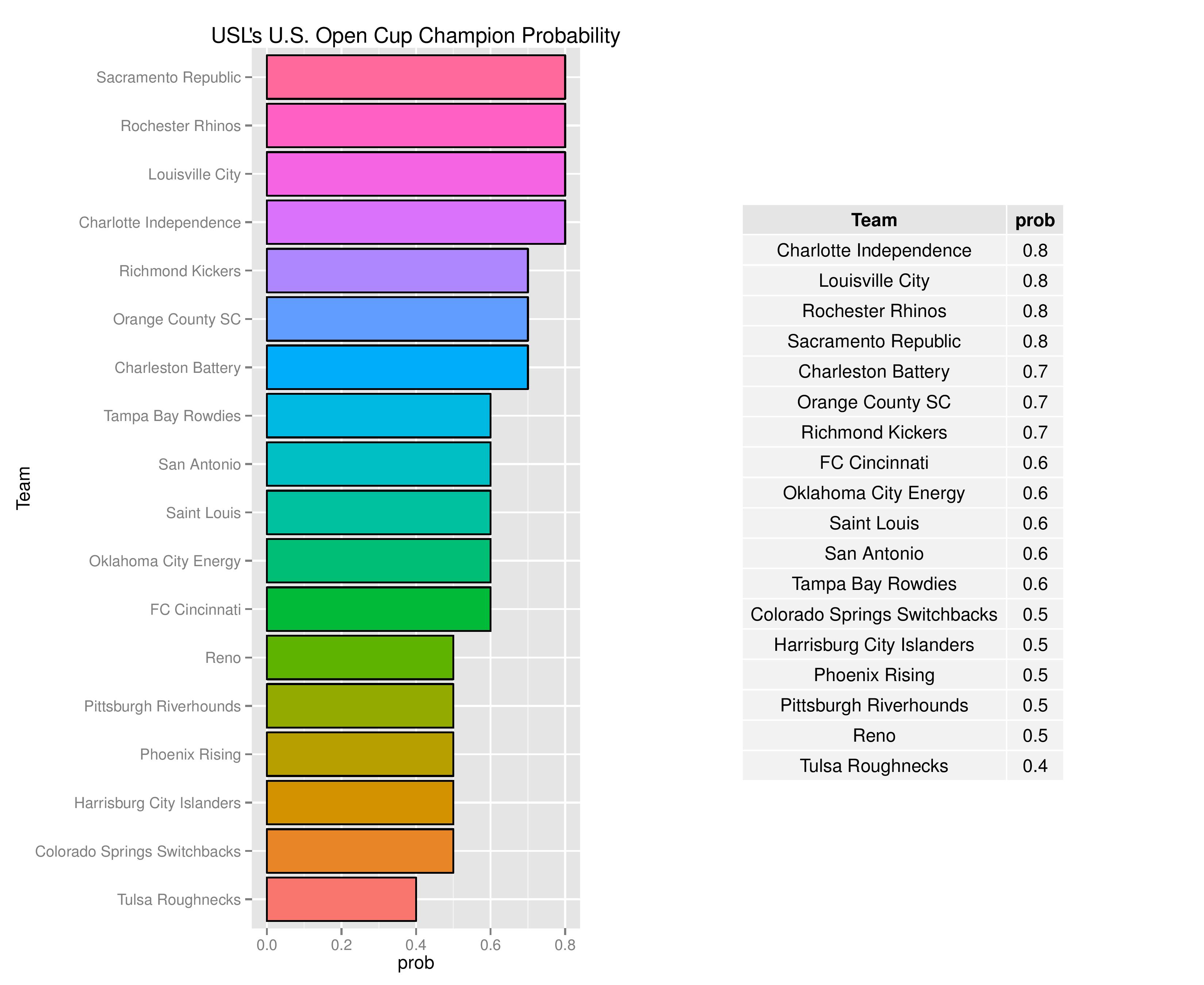

The USOC odds for USL clubs alone are as follows. Harrisburg remains at 0.5% odds. Bethlehem, being Philadelphia-controlled, is not eligible for the U.S. Open Cup.

Over time, we can see how the odds for different prizes change for Bethlehem and Harrisburg.

The following are probabilities for each category of outcomes for Bethlehem.

The following are probabilities for each category of outcomes for Harrisburg City.

The following shows the relative probability of the prior categories. If the projection system were entirely random, these bars would be even, despite that “Missed Playoffs” is inherently 14 times more likely than “USL Champion.” The chart outlines where the club is headed. We begin with Bethlehem Steel.

The following shows the probability of each post-playoff ranking finish.

The following shows the summary of the simulations in an easy table format.

As a new feature, we can also show how the Remaining Strength of Schedule affects each team.

The “Points Percentage Advantage” shown on the X-axis represents the percentage of points expected over the league average schedule. This “points expected” value is generated by simulating how all teams would perform with all remaining schedules (and therefore judges a schedule based upon how all teams would perform in that scenario).

In short, the higher the value, the easier the remaining schedule.

Remaining home field advantage will make a large contribution here. It can also be true that a better team has an ‘easier’ schedule simply because they do not have to play themselves. Likewise, a bad team may have a ‘harder’ schedule because they also do not play themselves.

The table following the chart also shares helpful context with these percentages.

Accompanying the advantage percentage in the following table is their current standings rank (right now ties are not properly calculated beyond pts/gd/gf), the remaining home matches, the remaining away matches, the current average points-per-game of future opponents (results-based, not model-based), and the average power ranking of future opponents according to SEBA.

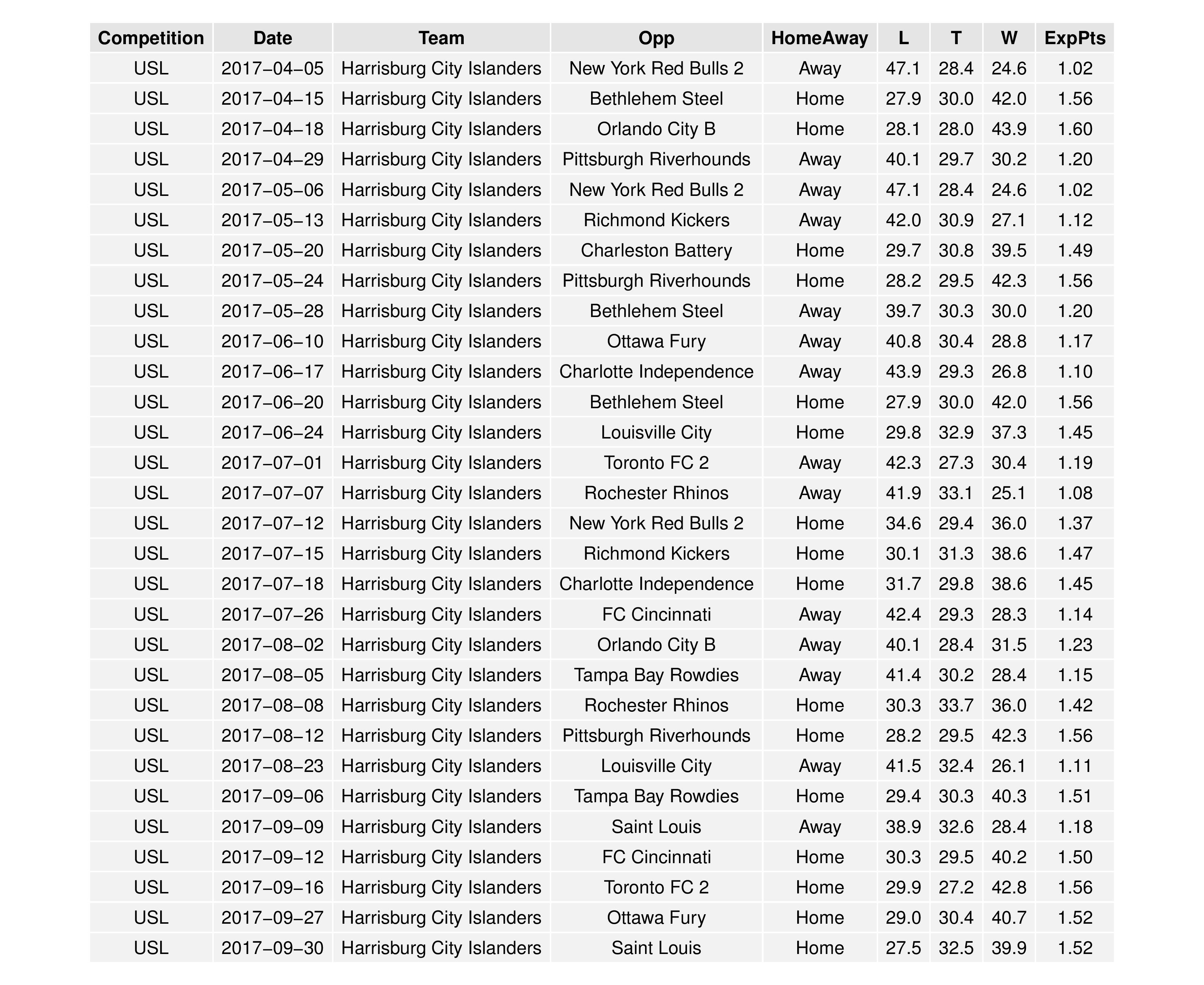

The following shows the expectations for upcoming matches for both Bethlehem and Harrisburg:

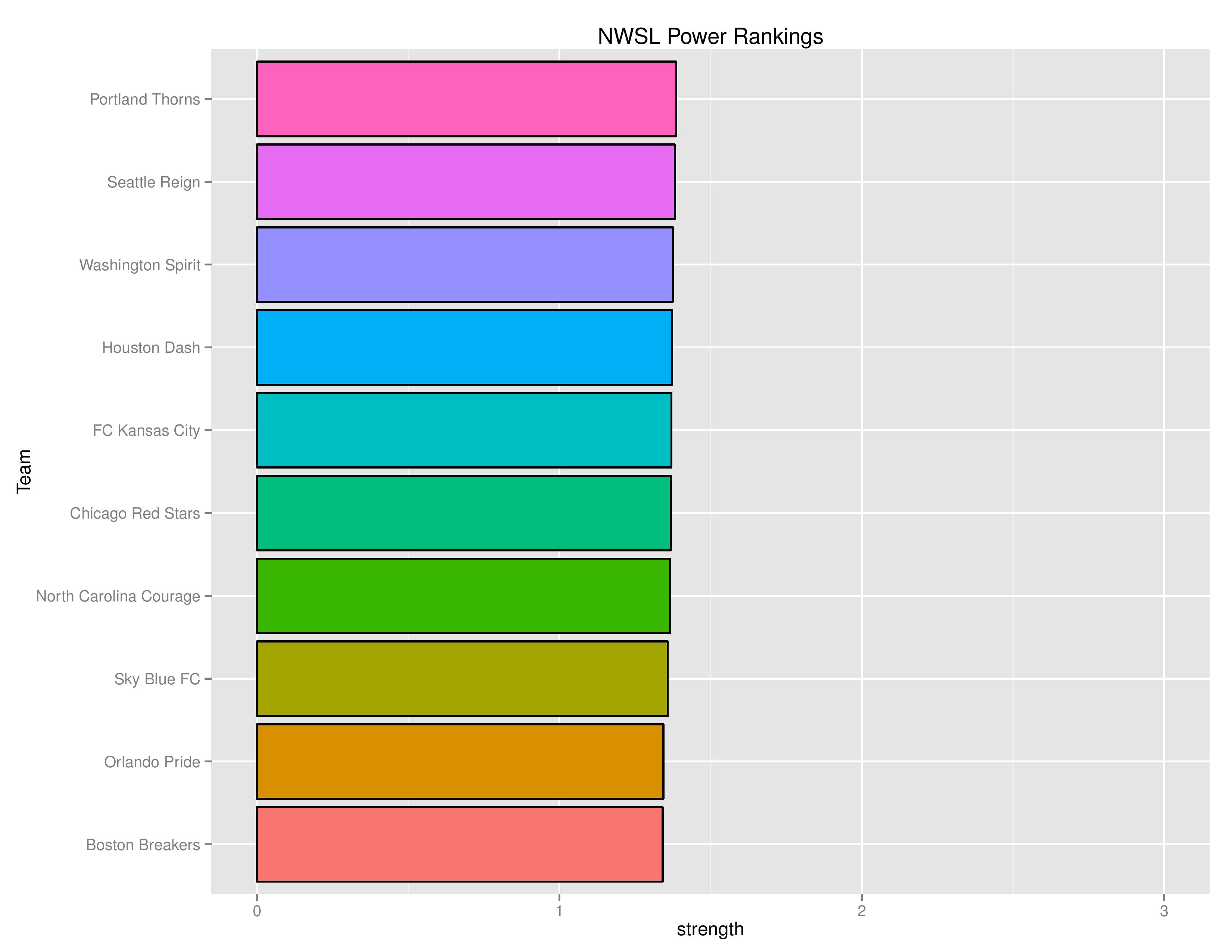

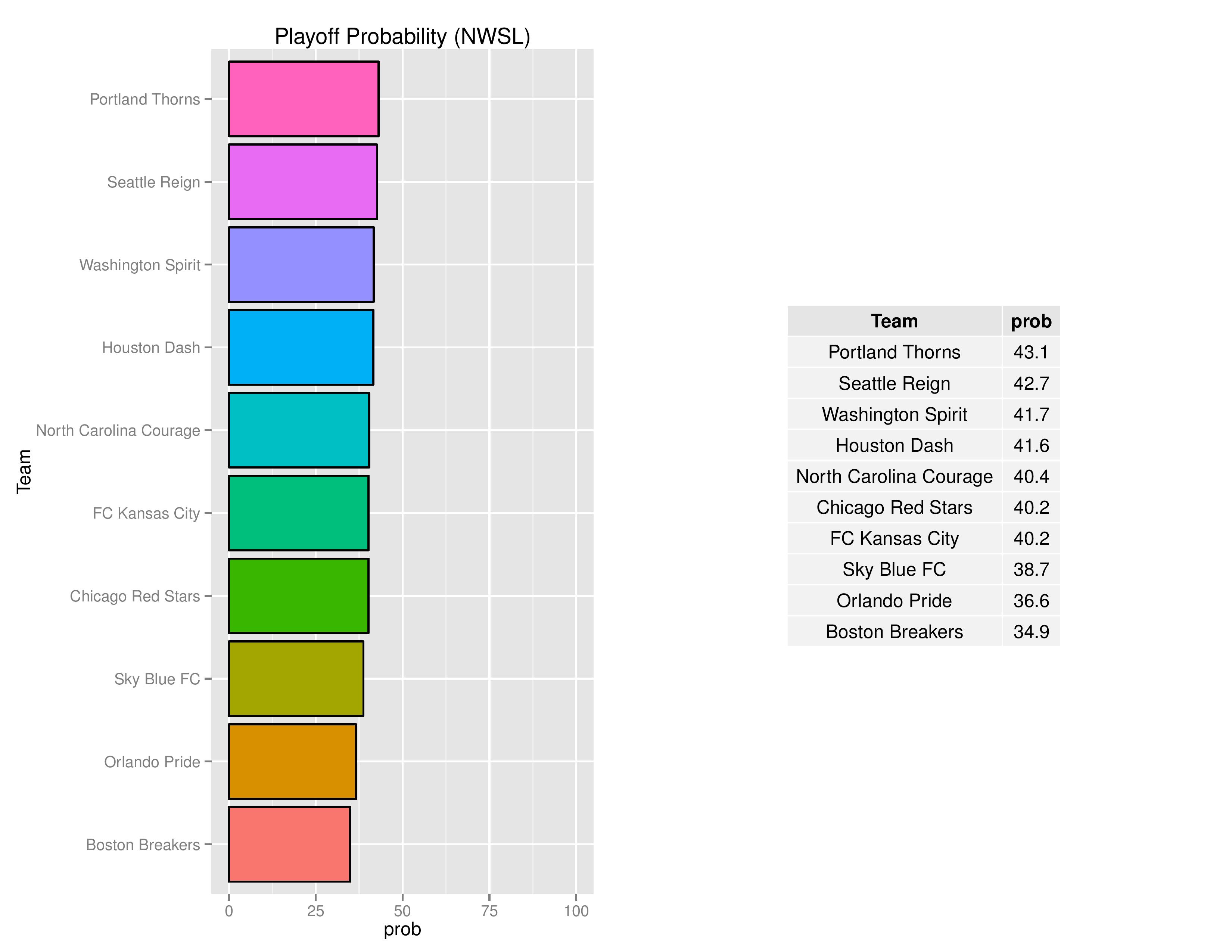

NWSL

Without a Philadelphia club in NWSL, I will limit the commentary with each chart. Additionally, the charts all follow the same pattern as with MLS and USL forecasts.

Unlike last season, where NWSL clubs were looped into the same model as MLS/USL (as well as NASL, USOC, and Liga MX), NWSL now has it’s own model. This will the allow the model to make bolder assessments of team abilities without relying as much on home field advantage. This will better represent the higher variance of club talent in the NWSL that was apparent in 2016.

As was with the preseason forecast of MLS and USL, this preseason forecast of NWSL is based entirely off of 2016 season data.

The SEBA Projection System is an acronym for a tortured collection of words in the Statistical Extrapolation Bayesian Analyzer Projection System. Check out the first season’s post to find out how it works (https://phillysoccerpage.net/2017/03/03/2017-initial-seba-projections/)

Comments